- Home

- Industries

- Insurance and Financial Industry

Insurance and Financial Industry

Market Demand and Changing Customer Behavior

As demographic structures, economic conditions, and technological habits evolve, the insurance and financial sectors are facing new market demands. Younger generations prefer online services, instant responses, and personalized plans, while corporate clients emphasize risk management and financial transparency. These diverse needs are driving institutions to rethink product design, service models, and marketing strategies.

From mobile banking and online claims processing to robo-advisors, every aspect of financial services is accelerating toward digitalization and intelligence—enhancing customer experience, transforming business operations, and enabling faster, more transparent, and more personalized financial engagement.

Technological Innovation and Operational Efficiency

Artificial intelligence, data analytics, blockchain, and automation tools are redefining the core operations of the insurance and financial industries. Risk assessment is becoming more precise, claims processing faster, and compliance monitoring more efficient.

By integrating intelligent technologies, financial institutions can not only reduce costs but also enhance service quality and decision-making speed—making operations more agile, resilient, and future-ready.

New Challenges in Regulation and Sustainability

As fintech continues to evolve rapidly, compliance, cybersecurity, and sustainability have become essential priorities. Global ESG initiatives are fueling the rise of green finance and sustainable investment strategies, while the expansion of digital finance demands stricter data protection and regulatory compliance standards.

Moving forward, the insurance and financial sectors must balance innovation with regulation to ensure long-term stability and sustainable growth.

Industry Pain Points

1.Fragmented Customer and Transaction Data

- Customer information, policy records, claims history, and investment data are dispersed across multiple systems, lacking integration and centralized management.

- This fragmentation hinders real-time, accurate risk assessment, claims decisions, and personalized financial services.

2.Growing Cybersecurity and Compliance Risks

- Financial institutions handle massive amounts of sensitive information, facing increasing pressure to ensure transaction security and privacy protection.

- The complex and evolving regulatory environment requires significant resources to maintain compliance and risk control.

3.Complex Regulatory and Supervisory Environments - Different countries and regions enforce diverse regulatory frameworks, forcing financial institutions to invest heavily in compliance efforts, increasing operational burden.

4.Incompatibility Among Core Systems - Financial systems from different eras or vendors often lack standardized interfaces, reducing cross-system data exchange efficiency.

- Legacy systems cannot deliver real-time transaction or risk control feedback, slowing decision-making and impacting customer experience.

Solutions

| Product/Solution | 功能與特點 | 對應痛點 | 解決的挑戰 |

|---|---|---|---|

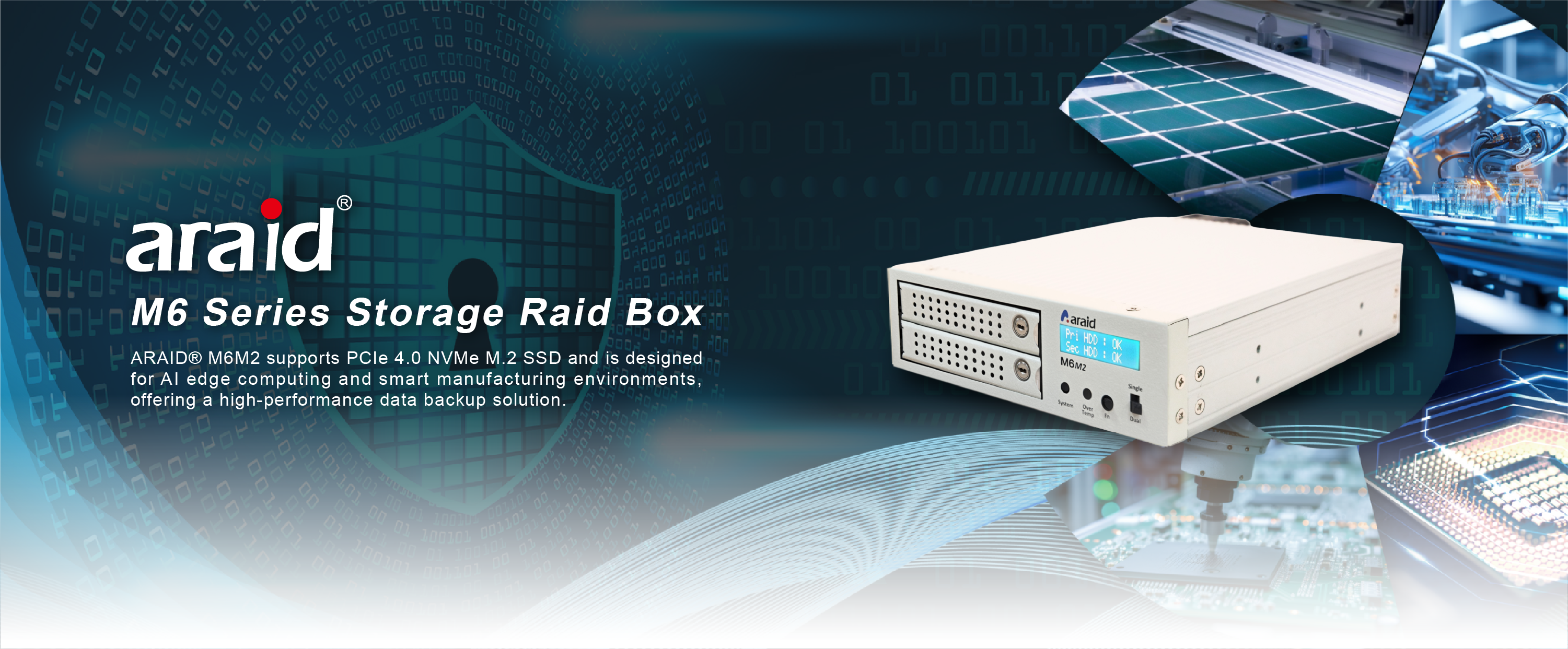

| ARAID® RAID Enclosure | High-speed backup and instant recovery, ensuring uninterrupted operation | Fragmented customer and transaction data | Centralizes and synchronizes system data to ensure consistency, availability, and reliability. |

| PLC+ Remote Control and Data Collection Solution | Smart integration with legacy PLC devices, supporting multiple communication protocols | Low cross-system data exchange efficiency | Connects and synchronizes data interfaces across diverse systems and generations for seamless real-time communication. |

| RCVM Remote Monitoring Solutions | Remote monitoring of real-time machine status, troubleshooting, maintenance support, and operational analysis | Complex regional regulatory differences | Enables real-time monitoring of transaction flows and anomalies, strengthening cybersecurity and risk control. |

Application Scenarios

Conclusion

The insurance and financial industries are entering a new era of intelligence, platformization, and sustainability. Facing challenges of sensitive data handling and stringent regulations, only by combining data security and intelligent decision-making can organizations maintain a competitive edge.

Accordance with its core strengths in data protection, system integration, and intelligent execution, delivers comprehensive digital solutions—from edge backup and intelligent automation to centralized monitoring—empowering financial and insurance institutions to build a smarter, safer, and more sustainable financial ecosystem.